By: Ajay Madhvani, MAI, AM Valuation Services, PLLC, in Tucson

By: Ajay Madhvani, MAI, AM Valuation Services, PLLC, in Tucson

TUCSON, AZ (June 17, 2024) — This report aims to show the strengths and weaknesses of Tucson, Arizona, and its sister cities, namely Albuquerque, New Mexico, and El Paso, Texas. This trio is a sisterhood, as they have many commonalities, including climate and population size. They also all share the distinction of a military base and a university. The statistics and data shown herein illustrate the big picture and may not reflect exact figures. Since our last publication in July of 2023, some changes have occurred. These changes include, but are not limited to, solar projects, new employers, inflation and interest rates remaining high, and new infrastructure projects.

Tucson, Arizona

Tucson is about 60 miles north of the US-Mexico border and about 100 miles south of Phoenix, Arizona. The metropolitan population is about 1.04 million but the 2020 US Census Bureau reports a population of about 543K. Major industries in Tucson include defense/aerospace, healthcare, and mining. Tucson has a minor league hockey and soccer team, and an arena football team, but the most followed teams are associated with the University of Arizona. The Old Tucson Studios have been revitalized with concert, filming, Halloween, and Christmas venues. Another entertainment venue approved in March of 2024 is the Mosaic Quarter along the southeast side of I-10 and Kino Parkway. The project will include a 3,000-seat ice rink, large field house, sportsplex, and pavilion.

The current real estate trends include the build-up of downtown with new multi-family developments, street-car transportation, student housing, hotels, restaurants, and retailers. Tucson has also become a distribution hub for Southern Arizona with the Port of Tucson. The Port of Tucson is a full-service inland port, rail yard and intermodal facility. The port consists of 767 acres with 50,000 linear feet of rail track, with cold storage, dry storage, distribution, and manufacturing. Tucson International Airport completed a $360 million project that added a parallel runway with the addition of new taxiways, aircraft guidance systems, and modernization of the airfield geometry to meet current FAA standards. In October of 2023, Tucson Electric Power announced plans for the Roadrunner Reserve project, which is a 200-megawatt, and 800-megawatt-hour batter energy storage system located in southeast Tucson. This project will have the capacity of powering 42,000 homes for four hours. The construction is anticipated to begin in the summer of 2025. There are four Amazon facilities in the Tucson area: the 857K SF Fulfillment Center built in 2019, the 49,500 SF “Last Mile” facility, 270K SF Delivery Station, and the newest is a 220K SF facility in Marana. The Marana facility has been completed, and currently operating at about half capacity.

There are also plans by American Battery Factory to construct a 2 million SF lithium iron phosphate battery plant, which will create 300 jobs at the onset and will be scaled up to a thousand jobs, with $3.1 billion in economic impact to Arizona. The expected opening is in Spring of 2025. Sion Power Corporation, a Tucson-based battery developer for electric vehicles signed a pair of leases totaling 212K SF. The expansion is expected to be complete by 2026 and will create over 150 high quality jobs. Becton Dickinson is building a 120,000 SF final stage manufacturing and sterilization facility on 32 acres, on the northeast side of Kolb Road and Valencia Road. The company says that the facility will employ about 40 skilled people and the facility will cost $65 million. Hudbay Minerals is beginning Copper World Complex on the west side of the Santa Rita Mountains, about 28 miles southeast of Tucson. Copper World Complex is anticipated to be a 44 year mining project and will create 400 direct jobs. As of early 2023, Hudbay was carving roads, drill pads and clearing ground for tailings piles. The project is still awaiting permits for aquifer protection and air quality. In February of 2024, Belden leased 302,443 SF at 3610 E. Valencia Road for a state of the art manufacturing facility. Shamrock Foods also acquired 81 acres for a distribution center in Marana, but no construction plans have been announced yet.

An on-going issue with Tucson as well as the other two cities is water availability. Tucson is heavily dependent on the Central Arizona Project (CAP) canal for water, which may be less

available in the long-term with ongoing cuts from long-term droughts and over usage. However, the water table is currently up from prior years with an estimated 5.5 years of excess Colorado River water in aquifers. Other options will have to be visited soon for Tucson to grow at a sustained rate.

The major difference between Tucson and its sister cities is that it is in the shadow of a much larger city. The Phoenix metropolitan area is about 5 million people and has sports venues, a much larger international airport, corporate industries, loop freeways, and a light rail line. This is both a benefit and a detriment to Tucson. It could be seen as a detriment, since the state and corporations focus their time and energy on the greater Phoenix area.

Albuquerque, New Mexico

Albuquerque is about 300 miles north of El Paso, 400 miles northeast of Phoenix, Arizona, 400 miles south of Denver, 450 miles northeast of Tucson, and 600 miles east of Las Vegas. The metropolitan population is about 922,296 and the 2020 US Census Bureau reports a population of about 565K. Major industries in Albuquerque include Defense/Aerospace, Bioscience, Renewable Energy, Digital Media and Film, and Manufacturing.

Albuquerque is the hub for New Mexico and has a rich culture. The city has a strong central downtown core, four seasons, minor league baseball, hockey, and soccer teams; as well as an indoor football team. Like Tucson, Albuquerque has a revitalized convention center known as Tingley Coliseum. Albuquerque is served by two interstates, also like Tucson. The city has similar water issues like Tucson but the water table is up from past years due to active water conservation and reclamation efforts.

Albuquerque has a commuter rail line, known as Rail Runner, traveling north-south from Belen, through the city, and to Santa Fe, about 60 miles to the north, and the Albuquerque Rapid Transit (ART). The Rail Runner and ART connect metro Albuquerque visitors and residents to various destinations throughout the area. New developments continue on the west side of the city. The city generally grows to the west, given the surrounding public lands and geography of the land to the north and east. Downtown 2025 is an initiative in Albuquerque. The goal is “To make Downtown Albuquerque the best mid-sized downtown in the USA.” There are many strategies for Downtown 2025 including: enhancing the character of the neighborhoods, maintaining downtown as the largest employment center in New Mexico, and making downtown a tourist destination. In December of 2022, the City of Albuquerque announced a $95 million Industrial Revenue Bondfor the creation of New Mexico’s first stand-alone battery energy storage system (BESS) known as the Sandia Peak Grid BESS project. The facility will store energy from renewables like solar and wind, and used when demand requires. The project is estimated to create between 60-100 local jobs during construction and generate $6.7 million in tax revenue over 20 years.

For newer employment opportunities, Albuquerque has recently added a 2.8 million SF Meta/Facebook Data Center, and a 441K SF Amazon Fulfillment Center completed in mid-2021.

In October of 2018, Netflix purchased a 257k SF production facility from Albuquerque Studios for film production. In June of 2024, there was an announcement that Rocket Labs will be expanding their facility for 100 manufacturing jobs. Rocket Labs manufactures solar cells for spacecraft and satellites. The company will be using funds from the U.S. Department of

Commerce. The funds come via the federal CHIPS and Science Act, which will provide up to $23.9 million for the expansion. In April of 2024, Array Technologies breaks ground on new manufacturing facility. The manufacturing campus reportedly will cost $50+million and will comprise of 216,000 SF. The campus will employ 300 residents, and will be located on

Albuquerque’s west side. In January of 2024, Boeing announced they completed their addition of 27k square feet to their current facilities. The expansion costs $5+ million, and will bring 20-30 jobs in 2024. The facility specializes in anti-drone technology to assist the military defense system.

El Paso, Texas

El Paso, Texas is about 300 miles south of Albuquerque and 300 miles east of Tucson. The metropolitan population of the city is about 869,000 and the 2020 US Census Bureau reports a population of about 679K. Major industries in El Paso include manufacturing, data centers, renewable energy and sustainable industries, and transportation and logistics. The El Paso

economy is largely based on how well and how safe Ciudad Juarez is at any given time. El Paso also benefits from its vicinity to the border and despite its rowdy neighbor Juarez, El Paso is one of the safest cities in the United States.

Recent trends in El Paso include a downtown that is being revitalized with new hotels, housing options, mixed use developments, a baseball stadium, and repurposing of buildings. The El Paso Streetcar opened in 2018. This project runs about 5 miles from downtown to the university in restored streetcars. The city is growing on the east and west ends with new residential and retail developments. There is also a proactive local developer who has been repurposing historic properties throughout the city. The area near Fort Bliss is also seeing new retail and residential development. El Paso is also ahead of the curve with regards to water treatment, as the city is utilizing a desalination plant. The desalination plant is the world’s largest inland desalination plant and can produce up to 27.5 million gallons of fresh water daily. The water is drawn from the nearby Hueco Bolson. Overall, the market appears to be steadily growing and improving.

For newer employment opportunities, El Paso has become a logistics hub, and exports have grown 210% over the past decade. El Paso also has a 2.6 million SF Amazon Fulfillment Center completed in 2022. In addition, Hunt Companies recently delivered a speculative 262K SF, 20 story, Class A office tower, the first in 30 years in El Paso. The Sunset Amphitheater project in northeast El Paso was approved in April 2024 and is proposed as a 12,500 seat amphitheater that is expected to generate an estimated economic impact of $5.4 billion over the next 20 years. The amphitheater is anticipated to open in March 2026. In April 2024, the Felina Solar Resource broke ground on a 150 megawatt facility that will have close to 340,000 solar panels, which will produce 450,000 megawatt hours annually. The construction is anticipated to provide 250-300 full time jobs during construction.

In September of 2023, Eaton Manufacturing announced they will invest an additional $80+ million to increase the supply of its electrical power distribution solutions. The expansion will create more than 575 new skilled manufacturing jobs. In September of 2023, Schneider Electric announced they will build a new 160k square foot manufacturing plant. The facility is anticipated to create 400 new jobs. In October of 2023, Flagstone Foods’ announced they are expanding their facility for $28.2 million and will be hiring over 90 new employees. In October of 2023, Prod Design & Analysis also announced a $6 million expansion and will be hiring 48 new employees.

Population Statistics

The populations of the three metropolitan areas are similar. However, the 2020 census numbers are much lower. This is simply the result of city limits. Tucson is 241 square miles, Albuquerque is 187 square miles, and El Paso is 259 square miles. All three cities are spread out, accounting for the large difference in metropolitan population versus census figures. The population of each city is shown in the following table.

Population Growth

The populations of all three cities have grown by a small amount from 2020 to 2023, and at a generally similar pace at 0.3% and 0.1%. All three cities were growing at faster rates from 2010 to 2020, at 0.38% in Tucson, 0.65% in Albuquerque, and El Paso grew at 0.81% annually.

Median Household Income

The U.S. median household income was $75,149 in 2022. All three cities have a lower median household income than the national median. Fortunately, all three cities have posted an increase in median house household income from 2017. The lower wages are attributed to the vicinity to the border and inexpensive living costs. Unfortunately, there are also concerns with high rates of poverty in all three cities.

Top 10 Employers

The top 10 employers in Tucson account for over 75K jobs in 2020. In Albuquerque the top 10 employers account for over 86K jobs in 2023, and for El Paso, over 96K jobs. A military base is one of the top 3 employers in each of the sister cities, and governmental entities account for most of the jobs. Of the three cities, Tucson has the most private employers in the Top 10 with Raytheon, Banner, Freeport, and Wal-Mart. In addition, the Intel Corp. figure for Albuquerque of 3,500 in 2017 is also much smaller in 2023, by approximately 2,000 employees. Education and healthcare represented most of the top 10 in El Paso.

The top 10 employers account for 16% of the total workforce in Tucson, 20% in Albuquerque, and 26% in El Paso. Tucson has the largest number of employees, followed by Albuquerque, then El Paso. This is a slight shift from May of 2023, where Tucson had about 481,372 employees, Albuquerque had 428,185 employees, and El Paso had 360,235 employees. Generally, the number of employees correlate with each city’s population. The Tucson labor force is considered less risky than their counterparts since the top 10 employers account for the fewest number of total jobs.

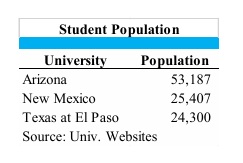

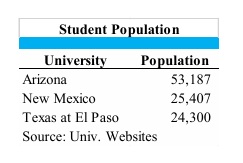

Student Population

All three cities have a State University with a significant impact on the local economy. The University of Arizona (UA) is the largest of the three and has the largest impact on the local economy and politics. The University of New Mexico (UNM) and Texas at El Paso (UTEP) also have a significant positive impact on their respective communities. From the previous 2022-2023 academic year, the UA has grown by 4%, UTEP had growth of 2%, and UNM had the greatest growth at nearly 16%. The table below shows the enrollment of the three universities, for the 2023 2024 academic year.

New Home Permits

The number of new home permits includes single-family and multi-family residences. Tucson shows much higher new home permits for 2023. On the other hand, Albuquerque and El Paso show generally similar new home permit figures.

Airport Statistics

The three airports vary greatly in arrival/departure statistics. The main reason Albuquerque’s traffic volume is much higher than Tucson and El Paso is that the city is distant from surrounding metropolitan areas. Albuquerque also receives a greater amount of volume from tourists traveling to nearby cities in the northern part of state, including Santa Fe and Taos. Tucson posts smaller figures since it is close to Phoenix’s airport, which has more travel options and often offers lower prices. The airport traffic statistics are shown in the following table.

Building Type Breakout

Next, we will discuss the hotel, apartment, industrial, office, and retail markets for each city. This discussion will illustrate each community’s strengths and areas for improvement.

Hotel

The hotel sector across the nation was greatly impacted by the COVID-19 pandemic, and is still in the process of recovering from the effects of the pandemic to pre-pandemic levels. In addition, new rental options such as Airbnb, VRBO, and other online options have become significant competitors to the conventional hotel market. The hotel room statistics in Tucson and Albuquerque are generally similar with room count and occupancy. The El Paso market by far has the most available rooms and this is primarily due to the its location on the US-Mexico border. All three cities are adding new rooms, which suggests continued demand for conventional hotels in the three markets.

Apartments

The Tucson market has the most apartment units of the three markets by a large margin. Tucson could have the most units of the three markets for several reasons. First, Tucson has the largest university of the three markets and the largest metro population of 1.063 million, versus 922K in Albuquerque, and 873K in El Paso. Secondly, Tucson has the lowest median household income of the three markets at $52K, versus $62K in Albuquerque, and $56K in El Paso. In the past, higher home prices in Tucson than the other two markets could have spurred new apartment development, to offer a lower priced housing option, but this is currently not the case. According to Redfin, the median home price in Tucson is at about $330K, versus $352K in Albuquerque, and $240K in El Paso. In the past, rental rates in Tucson could have been higher than the other two cities, but this is currently not the case either. The average effective rent is $1,229 in Albuquerque, $1,051 in El Paso, and $1,136 in Tucson. There are nearly 1,900 new units being constructed in Tucson and Albuquerque. El Paso also has the largest military base of the three markets with housing options on the base. This could be why El Paso has the fewest units and the fewest being constructed. Another variable to consider is that Tucson is closer to large Phoenix and California developers than the other two markets, saving time and money for construction and shipping materials.

Industrial

The industrial market is a good indication of manufacturing, production, distribution, and supply in a particular market. As shown in the table and graph below, El Paso has the largest industrial market. This is primarily due to the city’s location along the US-Mexico border. El Paso has become a logistics hub, and exports have grown 210% over the past decade. Albuquerque has the second-largest industrial market. The reason for this is that Albuquerque is distant from surrounding cities and therefore a more desirable geographic location for the distribution hubs and supply centers in between larger cities in the western United States, such as Los Angeles, Denver, Phoenix, and Oklahoma City. Tucson has the smallest industrial market which is primarily due to Phoenix being 100 miles to the north with a larger population, airport, and vicinity to surrounding cities. All three of the cities have grown from 3.3% – 9.5% from 2023 to 2024. El Paso added over five million square feet, and Albuquerque added 1.95 million square feet of new space during this time period. Tucson also added about 4.5 million square feet of new industrial space. The vacancy rate in all three cities has increased, especially in Tucson which was 3.40% in 2023 and now is 6.40%. The vacancy in Albuquerque increased from 1.50% in 2023 to 2.70% in 2024, while El Paso’s rate increased from 6.00% to 7.10%. There are new facilities under construction in all three markets, showing continued demand for industrial space in all three markets.

Office

The office market represents the corporate and small business market, financial strength, medical space, and production of a city. The COVID-19 pandemic has drastically changed the office market, with more people than ever before, working remotely from home. Albuquerque has the largest office market of the three cities. Once again, this is due to Albuquerque serving as a hub for New Mexico. Tucson has a smaller office market and this is due to Phoenix serving the large corporations in the region. El Paso has the smallest office market, but Hunt Companies recently delivered a speculative 262K SF, 20-story, Class A office tower, the first in 30 years in El Paso. Tucson’s office market grew the least from 2023-2024 with about 127,558 square feet of new space versus about 486,098 square feet in El Paso, and 780,890 square feet in Albuquerque. The vacancy rate for all three cities varied during this time period, with Albuquerque showing a slight decline from 4.90% in 2023 and is now at 4.80%. The vacancy rate in Tucson for 2024 is 10.8%, an increase from 9.8% in 2023, while El Paso’s rate decreased from 5.90% to 5.50%.

Retail

The retail market represents expenditure income, tourism, as well as the contributions related to the retirement and student populations. Notably, that there is a large influx of shoppers from Mexico seeking higher end products and a ‘shopping experience’ in all three cities, but primarily in El Paso and Tucson. Albuquerque has the largest retail market of the three cities. Once again, this is due to Albuquerque serving as a hub for New Mexico. Tucson has a similar sized retail market and this is due to Tucson’s vicinity to the US-Mexico border in addition to the large retirement and student populations. El Paso has a smaller but similar sized retail market, due to El Paso’s vicinity to the US-Mexico border. All three cities have grown slightly since 2023. El Paso’s retail market has grown about 0.81% with about 437,741 square feet of new space, Tucson has growth at 0.17% and 96,755 of additional square feet, and Albuquerque has an additional 445,123 square feet of retail space. The vacancy rate in all three cities did not fluctuate much, with Albuquerque showing an increase of 0.80%, Tucson increased slightly from 5.60% in 2023 to 5.7% in 2024, and El Paso’s rate dropped from 2.80% to 2.50%.

Conclusions

The three cities serve a similar demographic population, with military personnel, students, and retirees. The communities are similar in size and unsurprisingly have similar sized industrial, office, and retail markets. The hotel and apartment sizes vary between the three markets. All three cities have a downtown that is under revitalization, a civilian rail transportation system that was recently completed or under construction, and are actively managing water concerns. The markets are operating in a period of slow but steady growth.

Statistically, Albuquerque appears to be in the best geographical position and has capitalized on its strengths. Albuquerque has low vacancy rates across the five property types analyzed but has also been slow to add inventory. Albuquerque also has the highest airport volume and median income of the three cities. Overall, Albuquerque benefits from being the hub of New Mexico, good weather, and having low vacancy rates for the three major property types.

Tucson has done a good job of catering to the university market, and now has the largest employment base of the three cities. Because Tucson is the largest of the three cities and has the

largest university of the three cities, it has the potential for a more educated community. Tucson benefits from its vicinity to the border, and it could also further benefit from its vicinity to Phoenix, especially if Tucson had a connecting light rail system. Tucson could serve as a warehousing market for Phoenix companies, for example, it could offer more minor league sports and training programs to support the professional teams in Phoenix. Tucson could improve on catering to industry and collaborating with Phoenix. Tucson could further offer tax incentives, political cooperation, and improved infrastructure to cater to existing and potential employers. Tucson’s growth seems to be stunted by a lack of an east-west highway/freeway through the city. However, Tucson has great potential for growth with a large population base and student population, but it is in the shadow of a larger city.

El Paso appears to have captured the US-Mexico border business such as cold storage and retail, while catering to large manufacturers, and distribution centers to grow local jobs. The city’s safety is also appealing for growth and existing citizens. El Paso’s industrial market has strengthened the most of the three cities over the past decade, with significant delivery of new inventory. Overall, El Paso has capitalized upon its location along the US-Mexico border, its large military base, and is well positioned in the market.

All three cities are similar metropolitan areas, although with their distinct strengths and weaknesses. There is a long-term trend for all three cities that could be concerning in the future.

All three cities now have large solar power projects, which will most likely expand further. The growth rates for all three cities have slowed down from 2010-2020 levels. The three markets highlighted received an influx of people during the pandemic. However, there are population shifts back to larger cities. These larger metropolitan areas attract young professionals because they offer more job opportunities, amenities, and greater variety of services. This trend could change, as these three sister cities offer sunny weather, affordability, outdoor activities, and are less likely to be impacted by natural disasters. These three cities could also market their strengths better to attract younger talent.

Recommendations

The three sister cities may already be in the process of following these recommendations but there is no harm in repeating them. The cities could coordinate with one another and build alliances to serve a network for manufacturing and distribution. For a city to be appealing, the fundamentals must be addressed. These fundamentals include having a safe and clean place to live, good education, and strong youth programs. Unfortunately, homelessness and mental health issues have intensified in all three cities, but this appears to be occurring nationwide. There is an ongoing challenge to address the problem, but it appears to be a symptom of our nation’s current society, and needs to be addressed. A legislation and political system that is cooperative with the community and surrounding communities is also key for all three cities.

The cities could also have water issues going into the future so this could be an opportunity for the cities to team up with each other to creatively deal with the problem. The cities will likely be reusing (not recharging) their water in the future so the sooner the infrastructure is in place, the better. El Paso appears to be ahead of the other two cities in this regard, but it is still better to have diverse and varied water sourcing options. Another option would be to pipe in water from an area with a surplus of water, or desalinate water in the nearby Gulf of Mexico, and to construct a pipeline from there. The cities could invest in a pipeline structure together. Water harvesting programs and incentives could also be implemented in each city.

Lastly, these sister cities could offer better infrastructure. The core in each city would benefit from underground electricity lines, public transit systems, adding more efficient routes, and nicer roads. All three cities benefit from a high number of sunny days. Large scale solar energy has been in progress for all of the sister cities, but will only continue to grow with public support. There are also “mechanical trees” that remove carbon dioxide from passing air that could be utilized in all three cities, as temperatures quickly rise in the region. By building and expanding communication and wi-fi networks, the overall value of the city would increase. Water will be a continuous battle in the southwest, so adding water harvesting, gray water lines, and reclaimed water lines to golf courses, car washes, and parks will be helpful going forward. Improving the educational systems, either individually or collectively between the cities promotes responsible growth, infrastructure, and maintenance of the unique culture of each community. Preserving and promoting art, history, and culture is also an important piece to include in the infrastructure for each of these historically and culturally rich cities. Having art districts, murals, and other creative projects is an important and often overlooked part of a city’s infrastructure. All these factors would improve the cities appeal to employers, families, students, young professionals, and retirees.

The purpose of this analysis is to show the strengths and weaknesses of the three sister cities. The primary goal is to help achieve an improved quality of life for each. The secondary goal is to have a long-term sustainable future and to grow demand in the region. Growth is typically perceived as a positive thing. However, thoughtful growth, a long-term plan that serves a greater purpose, provides even greater benefits to a region.

Summation of Sister City Key Comparison Take-Away’s

Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special-use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmental agencies. Ajay has experience preparing reports for conventional lending, SBA, litigation work, eminent domain work, consultations, and appraisal reviews.

Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special-use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmental agencies. Ajay has experience preparing reports for conventional lending, SBA, litigation work, eminent domain work, consultations, and appraisal reviews.

Golf Cars of Arizona (Dereck Makowski, manager) bought the property at 4924 East 22nd Street in Tucson for $170,000 ($71 PSF). The former BAP Import Auto Parts consists of a 2,400-square-foot metal building is on a 13,601-square-foot lot.

Golf Cars of Arizona (Dereck Makowski, manager) bought the property at 4924 East 22nd Street in Tucson for $170,000 ($71 PSF). The former BAP Import Auto Parts consists of a 2,400-square-foot metal building is on a 13,601-square-foot lot.

By: Ajay Madhvani, MAI,

By: Ajay Madhvani, MAI,

Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special-use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmental agencies. Ajay has experience preparing reports for conventional lending, SBA, litigation work, eminent domain work, consultations, and appraisal reviews.

Ajay has experience throughout the State of Arizona, with primary experience in Southern Arizona and the Navajo Nation. Ajay is a designated member of the Appraisal Institute (MAI) and is licensed as a Certified General Real Estate Appraiser in the States of Arizona, New Mexico, and Utah. Ajay has experience in apartments, student housing, vacant land, subdivisions, office buildings, retail buildings, service stations, industrial buildings, mobile home parks, self-storage facilities, business site leases, and special-use properties. Ajay’s clients include private individuals, corporate organizations, banks, attorneys, and governmental agencies. Ajay has experience preparing reports for conventional lending, SBA, litigation work, eminent domain work, consultations, and appraisal reviews. Phoenix, AZ. (January 24, 2024) – ABI Multifamily, the leading multifamily brokerage and advisory services firm in the Western US, is pleased to announce the $1,700,000 / $212,500 Per Unit / $287.16 Per SF sale of 7232 – 7234 East Belleview Street, an 8-unit multifamily apartment community located in Scottsdale, Arizona. ABI Multifamily’s Mitchell Drake, Carson Griesemer, and Dallin Hammond represented the buyer and seller in this transaction.

Phoenix, AZ. (January 24, 2024) – ABI Multifamily, the leading multifamily brokerage and advisory services firm in the Western US, is pleased to announce the $1,700,000 / $212,500 Per Unit / $287.16 Per SF sale of 7232 – 7234 East Belleview Street, an 8-unit multifamily apartment community located in Scottsdale, Arizona. ABI Multifamily’s Mitchell Drake, Carson Griesemer, and Dallin Hammond represented the buyer and seller in this transaction. Phoenix, AZ. (December 15, 2023) – ABI Multifamily, the leading multifamily brokerage and advisory services firm in the Western US, is pleased to announce the $3,250,000 / $270,833 Per Unit / $288.12 Per SF sale of McKemy, a 12-unit multifamily apartment community located in Tempe, Arizona. ABI Multifamily’s Carson Griesemer, Dallin Hammond, and Mitchell Drake represented the buyer and seller.

Phoenix, AZ. (December 15, 2023) – ABI Multifamily, the leading multifamily brokerage and advisory services firm in the Western US, is pleased to announce the $3,250,000 / $270,833 Per Unit / $288.12 Per SF sale of McKemy, a 12-unit multifamily apartment community located in Tempe, Arizona. ABI Multifamily’s Carson Griesemer, Dallin Hammond, and Mitchell Drake represented the buyer and seller.