CBRE: Post-Labor Day Uptick in Office Space Utilization May Not Satisfy Companies’ Expectations

An anticipated post-Labor Day uptick in employee utilization of office space may not be enough to satisfy many companies’ expectations, according to a recent survey of 176 corporate end users by CBRE and CoreNet Global. As employers search for ways to increase office usage, they are focusing on making their space design compelling enough to attract employees back to the office.

An anticipated post-Labor Day uptick in employee utilization of office space may not be enough to satisfy many companies’ expectations, according to a recent survey of 176 corporate end users by CBRE and CoreNet Global. As employers search for ways to increase office usage, they are focusing on making their space design compelling enough to attract employees back to the office.

Most companies believe that the office is a fundamental tool for business success and want employees in the office more often.

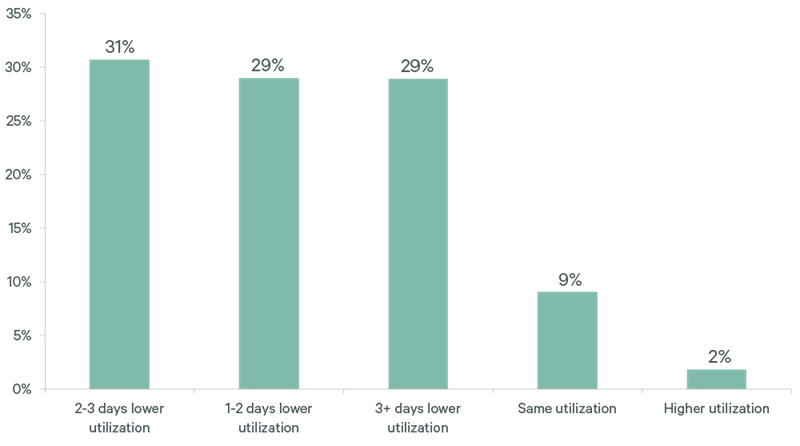

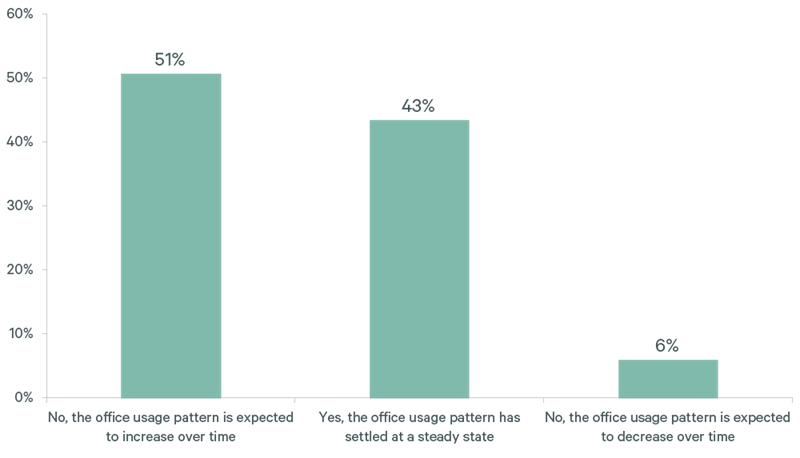

Although 84% of survey respondents want their employees in the office at least 2.5 days per week, 60% indicated that pre-Labor Day usage levels were more than two days below the pre-pandemic average of 4.4 per week in 2018 (Figure 1). While 43% of survey respondents believe that current office utilization levels constitute a “new normal,” 51% expect the level will continue to increase after Labor Day (Figure 2).

FIGURE 1: How does the current cadence of employees visiting the office compare to before the pandemic?

Source: Occupier Survey, CBRE & CoreNet Global, August 2022.

FIGURE 2: Is the pattern of employees visiting the office settled at a steady state today?

Source: Occupier Survey, CBRE & CoreNet Global, August 2022.

Employer and employee expectations are not aligned; companies can do more to close the gap.

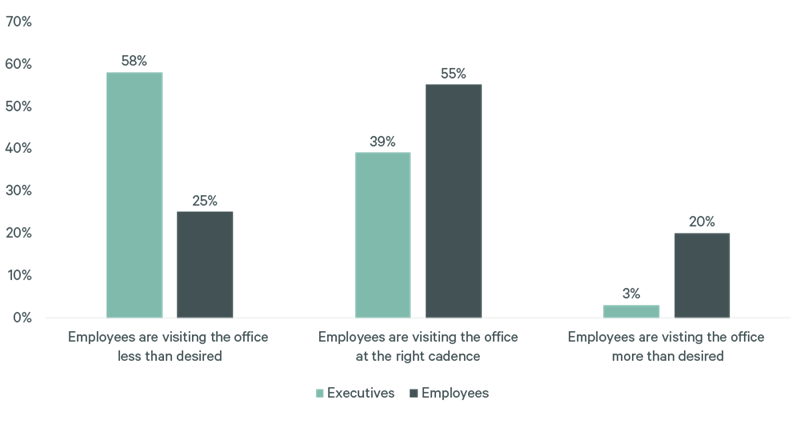

Companies that expect an increase in office usage face a unique challenge in getting employees to change behaviors. Only 25% of respondents believe that their employees would voluntarily come into the office more often than they do today. By contrast, 58% say that executive leadership would like employees in the office more (Figure 3).

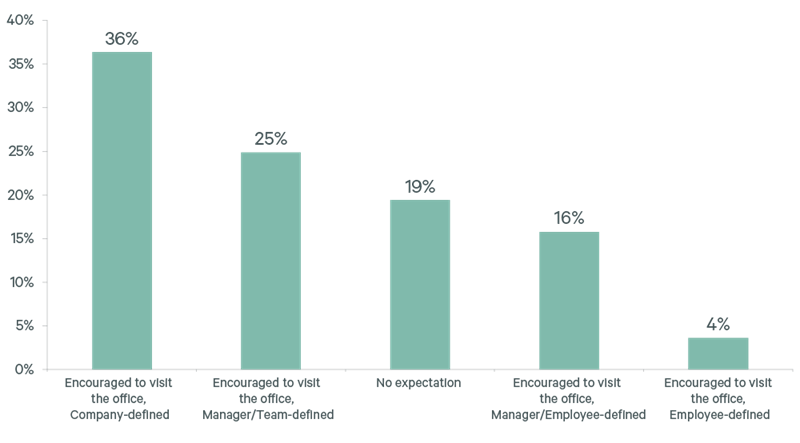

This disconnect between employer and employee expectations is leading some companies to encourage employees to work in the office more often. Sixty-one percent of survey respondents indicated that office utilization levels are defined by either a companywide or divisional policy. This sentiment has grown since CBRE’s Spring 2022 U.S. Office Occupier Sentiment Survey.

FIGURE 3: Executive Sentiment vs. Their Perception of Employee Behavior Regarding Return to Office

Source: Occupier Survey, CBRE & CoreNet Global, August 2022.

FIGURE 4: Which of the following best describe your current guidance for most employees regarding return to office?

Source: Occupier Survey, CBRE & CoreNet Global, August 2022.

Respondents were evenly split on whether an economic recession would lead to increased office utilization rates. Reasons that it would include employees’ fear of job loss and employers’ belief that more office usage would improve the company’s overall business performance.

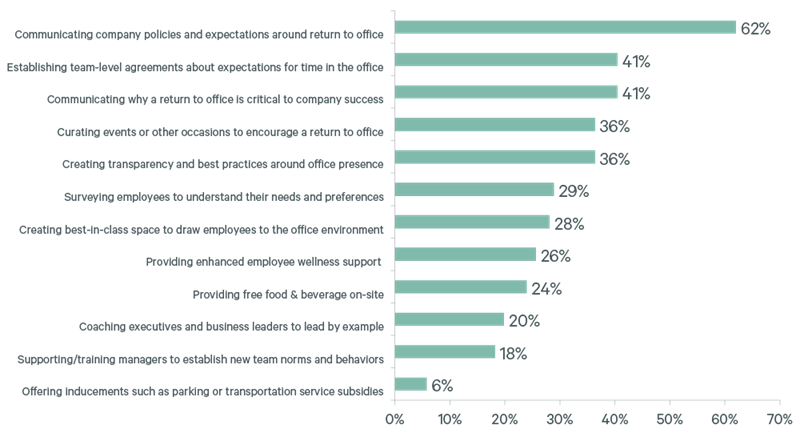

Companies need to implement more than communication measures to encourage an increase in office usage by their employees.

While more than 60% of survey respondents said their company is communicating expectations of their employees’ office usage, more than half say their people are returning more slowly than they would like. Only a few companies are currently focusing on critical areas to truly change employee behavior, including building consensus around why a return to office is critical to the success of the company. Other imperatives include defining best practices about office presence, surveying employees to understand their needs and preferences and supporting manager training to establish new norms and behaviors. The support of manager training is especially important to help teams better set, communicate, execute and measure goals that contribute to organizational effectiveness. New manager skills must be built to support a new way of work.

FIGURE 5: How is your organization engaging employees regarding return to the office?

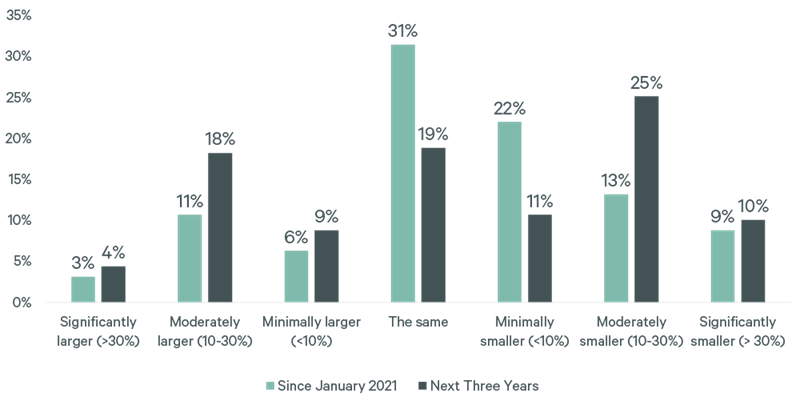

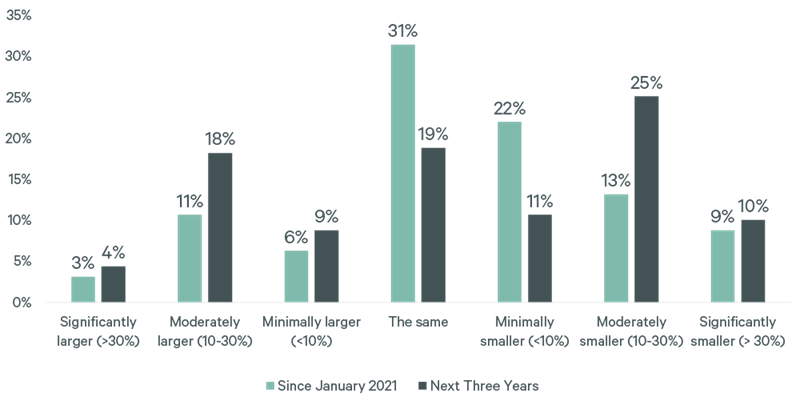

Long-term portfolio planning remains top of mind for companies.

While occupiers remain cautious and leasing activity is still below pre-pandemic levels, there is some evidence that more companies are prepared to make long-term commitments. Thirty-one percent of respondents said they anticipate adding to their office portfolio over the next three years, 19% foresee it remaining the same and 46% see it getting smaller. That’s a change in some cases from the past 20 months: Only 20% of respondents said their office portfolios had expanded since January 2021, while 31% were unchanged and 44% had shrunk. In each timeframe, 4% of respondents were unsure if change had taken place. Clearly not all occupier decisions are being driven by cost reduction or a desire to shrink their overall footprint.

FIGURE 6: Status of Real Estate Portfolio

Companies are spending to make their leased space more attractive and productive for their employees, including more collaborative space and more effective communication and scheduling tools. They also are enhancing workplace amenities, including wellness design and services and upgrading video-conferencing technology to better bridge the gap between those working inside and outside the office.

FIGURE 7: What areas do you anticipate spending more on to support the steady state your organization aspires to?

Source: Occupier Survey, CBRE & CoreNet Global, August 2022.

Note: All data is derived from the August 2022 Occupier Survey, conducted by CBRE in partnership with CoreNet Global.