Exclusive Interview with LAO’s Will White: 2023 Land & Housing Outlook

TUCSON, ARIZONA, February 10, 2023 — What comes as a surprise to no one, the land and housing market shifted dramatically over the past 6 months. While the end of 2022 was bleak, the industry is viewing this period as more of a ‘pause’ and not a longer-term downslide. The good news is that this categorization is in turn yielding significant optimism for 2023. Is this optimism real or unwarranted? There have been several theories on both sides of the argument, but the only clear thing is that no one knows for sure. We at RED News wanted to look deeper into the state of the current market and hopefully learn more as to what that will mean for 2023 and beyond.

What has now become an annual tradition, we went to the “source” for land and homebuilders in metro Tucson, Will White of Land Advisors Organization.

We caught up with Will recently to ask some of our questions and gather his thoughts on the 2023 Outlook. Will and his partner John Carroll at LAO are recipients of Trend Report’s inaugural “Best-in-Class” Award and represent the majority of Tucson’s master planned communities and high-profile residential projects and have been the dominant Land Brokers here for over 20 years.

Excerpts from our interview follow:

Will, this time I will let you start off. What are your general thoughts of the current market?

Interesting times, that’s for sure. Tucson is a unique place and I have been active in it day in and day out for 25 years now. I always get the question “what’s going to happen this year?” It might seem to be challenging, but a lot of it is predictable. Due to several macroeconomic factors, Homebuilders in Tucson stopped pushing a land agenda forward last summer. They are really waiting for many of these issues to settle and then will all be back to pushing that agenda forward. As their reaction was severe, what is most interesting to me is how large the reaction will be when the market turns. Personally, I think it is setting up to be one of the biggest pushes on land Tucson will have ever seen. Even though Q3-Q4 of 2022 was relatively quiet, I don’t think Tucson is going to lose all the momentum that was created.

Back up and review for us what happened in 2022.

2020-2021 was one of the best real estate markets any of us have seen in the last 20+ years, largely due to in-migration fueled by the COVID pandemic and low interest rates. Unfortunately, interest rates started moving sharply upward in June and as expected, homebuilders, figuring that they had bought plenty of land over the past 2 years, began to halt or extend their acquisitions. During their ‘wait and watch’ strategy, they also stopped pulling permits which was smart.

As Q4 wrapped up and the extensions did not provide the clarity, deals started to cancel. While probably the right move at the time, it will unintentionally make the supply problem worse as we move forward. You need to remember that deals take significant time to be completed and then there is the long, long road before physical supply can be delivered and communities are open for sale.

The good news for Tucson is that most of lingering deals were cleared out by year end. We are hearing from homebuilders that January was an unexpectedly solid month, and deals are beginning to be resurrected. While far from fully recovered, we are seeing positive signs of light.

What is different this cycle to the last? You have been through this before.

Yes, we have, and what we have learned is that each one is different. For example, if you look at permit numbers in the 2004-2007 cycle, it was for 35,000 homes. In the 2019-2022 cycle, it was 17,000. We built 18,000 less homes this time! This is a huge difference, and it underscores the point that we don’t have the supply overhang we did in the past. This pretty much all but guarantees a much quicker recovery than what we have seen in previous cycles.

It seems like you are focused more on the Supply-side of the equation than ever before. You have consistently hit on Supply over the years. How does that factor in now with the adjustment?

Coming out of the last cycle, Tucson homebuilders underproduced for about 9 years in a row. This was probably a strategy based on information of the time in the lean years. Homebuilders underdeveloped land and underbuilt homes; and in turn produced a market that was approximately 9,000 lots short heading into the COVID-era demand upswing. This supply/demand imbalance was the main reason behind the sharp rise in lots and median home prices. No question.

Fixing the supply situation in Tucson is now, and will continue to be, a huge challenge because of the position the market is in. We would have to grow community counts aggressively and get everyone to start listing their home on MLS. Both seem unlikely for the next few years, but we can hope!

What are some things that keep you up at night?

Absorption! At current, lowered, absorption rates, the Tucson market still needs about 17,000 finished lots to be delivered to builders in the next 5 years, and I have no clear picture as to where these will come from. I also don’t think we stay at these lower absorptions, so we really need more lots than that over the next 5 years. I have a very big concern on how we are going to provide large-scale infrastructure in the future for the rapidly growing areas in and around Tucson. The time and money required to get everything built in time is what could slow this area down, or at least make it an uncomfortable challenge for an extended period of time. The projects with infrastructure and approved plats will come at a premium.

How significant are increases in interest rates in the land brokerage business?

When rates move upward, and when there is talk of continued increases, it causes uncertainty. Uncertainty in real estate leads to deal pauses, and that is not good for business.

The good news is that pauses are always temporary, and the pendulum always swings back. We believe that things will be back in motion moving forward and that will be good for everyone.

Who benefits this time as we come out of this pullback?

The table in Tucson is set! It is very clear who will be providing lots to the homebuilders. The advantage will be to the owners for some time, and they will benefit. It will be the same projects in the same spots.

I think the first deals this year in the market will be the best for the homebuilders and once the market recalibrates and is back to more normal footing it will be as competitive – if not more so – as before.

What are the variables to the market rebound?

Well, don’t think for a minute that users, other than homebuilders, aren’t looking to snap up land in the desirable spots in the market. We are seeing rental builders looking to position themselves for long-term deals that have fallen out or aren’t in demand by “for sale” builders. We saw that disruption in 2021 and it was a land “game changer”. Also, we are seeing a heightened demand for land for retail and commercial uses that will further constrain the market here. I’d watch for those in the next 12-24 months.

Congratulations on your TREND REPORT “Best in Class” award. LAO is a volume leader, year after year, in residential land in Tucson. What do you do differently and what does LAO do in response to today’s market? Do you change the way you go about the business or is it full steam ahead?

In turbulent times, everyone thinks they need to totally change things to survive and to compete. While I think you need to be flexible in a fluid business like this where things change quickly, we have never felt the need to completely reinvent the wheel. We have a proven formula in our office and a big part of that is ALWAYS looking ahead to where the market is going, not just where it is today. We are fortunate to work for the best developers in the region and we will continue to advocate and press the pace on their behalf. We are thrilled at what we see for Tucson in the next several years.

Thank you, Will, for your time and insight.

Will White has led the Tucson office of Land Advisors Organization for over 22 years. Under his leadership, the Tucson office has been recognized as the leading land brokerage company in Tucson by volume for well over a decade. Will specializes in the representation of the area’s top master-planned and residential communities. His work with southern Arizona’s homebuilders is well documented and the office has been responsible for Tucson’s most high-profile land transactions and assignments. Will currently represents Tucson projects with a lot inventory exceeding 22,000 future lots and is a known go-to for speaking engagements and writing contributions. Will’s long-term relationships with many key players in Tucson and Pima County enables him to continually represent public and private homebuilders, master developers, and large financial institutions effectively and efficiently. He is a member the Southern Arizona Homebuilder’s Association, Big Brothers Big Sisters of Southern Arizona Chair of Advisory Board, and the has worked with Urban Land Institute in their Mentor/leadership program. He has consistently earned the CoStar Power Broker recognition in the Tucson Market, an achievement that is based on transaction volume and dollar value. Will graduated from the University of Arizona with a bachelor’s degree in regional development and earned his Arizona Real Estate license in 1997. He can be reached at 520.514.7454 or wwhite@landadvisors.com.

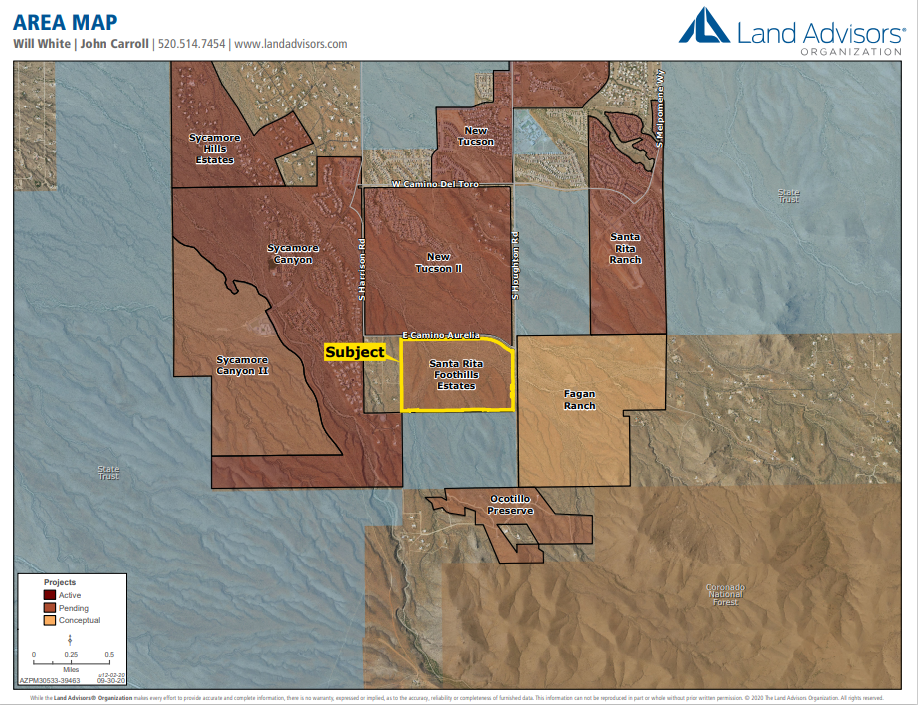

TUCSON, ARIZONA — Ocotillo Ridge (Tucson) ASLI IX, LLC along with Mark Voigt and Dave Rogers of Voyager Investment Properties in Phoenix closed on 217 acres in the Santa Rita foothills area of southeast Tucson for $2.85 million($13,134 per acre).

TUCSON, ARIZONA — Ocotillo Ridge (Tucson) ASLI IX, LLC along with Mark Voigt and Dave Rogers of Voyager Investment Properties in Phoenix closed on 217 acres in the Santa Rita foothills area of southeast Tucson for $2.85 million($13,134 per acre).