By: Ashok Chaluvadi in National Association of Home Builders February 6, 2025

By: Ashok Chaluvadi in National Association of Home Builders February 6, 2025

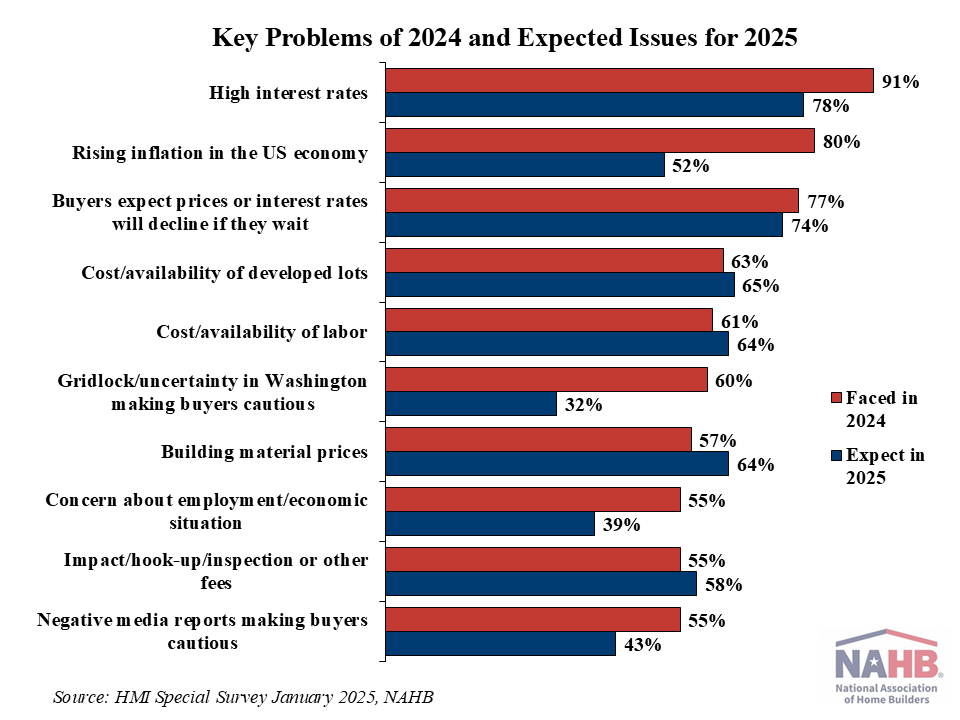

(February 7, 2025) -- The most significant challenge builders faced in 2024 was high interest rates, as reported by 91% of builders in the latest NAHB/Wells Fargo Housing Market Index survey. A smaller, albeit still significant share of 78% expect interest rates to remain a problem in 2025. The next four most serious issues builders faced in 2024 were rising inflation in the U.S. economy (80%), buyers expecting prices/interest rates to decline (77%), the cost/availability of developed lots (63%), and the cost/availability of labor (61%). Builders don’t expect much improvement in these challenges in 2025, except for rising inflation, which ‘only’ 52% see as a serious problem in the year ahead.

In addition to those top tier challenges, 55% to 60% of builders also reported facing serious problems in 2024 with gridlock/uncertainty in Washington (60%), building material prices (57%), concern about employment/economic situation (55%), impact/hook-up/inspection and other fees (55%), and negative media reports making buyers cautious (55%). Looking ahead at 2025, significantly fewer builders expect gridlock/uncertainty in Washington (32%) or have concerns about the employment/economic situation (39%). In contrast, more builders are expecting building material prices to be a problem in 2025 (64%) and about the same expect continuing problems with impact and other fees (58%).

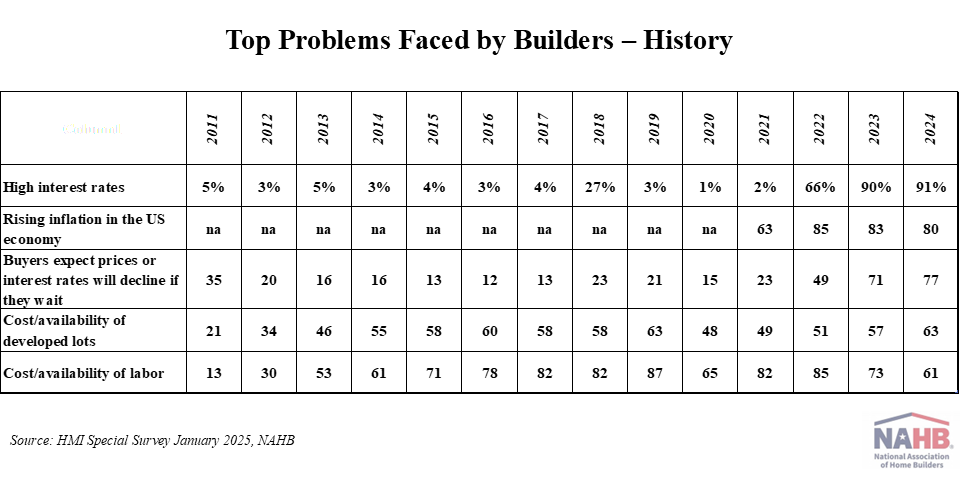

Builders have been asked about their most serious challenges every year since 2011. High interest rates have been a problem for a negligible share of builders (under 10%) during most years, except for 2022 (66%), 2023 (90%), and 2024 (91%). When first introduced to the survey in 2021, 63% of builders reported challenges with rising inflation in the U.S. economy, but the share grew to at least 80% in 2022, 2023, and 2024. Prior to 2022, relatively few builders reported problems with buyers expecting prices or interest rates to fall, but that share rose to 49% in 2022, 71% in 2023, and 77% in 2024.

The cost/availability of developed lots has been a serious challenge to most builders in nine of the 14 years of the series history. In 2022, 51% of builders faced this problem; by 2024, 63% did—tying a record high set in 2019. Meanwhile, more than half of builders have reported the cost/availability of labor as a serious problem for the past 11 years in a row. While 82% and 85% of builders faced this challenge in 2021 and 2022, respectively, the share has eased to 73% in 2023 and to 61% in 2024.

Please consult the full survey report for additional details, including a complete history for each reported and expected problem listed in the survey.