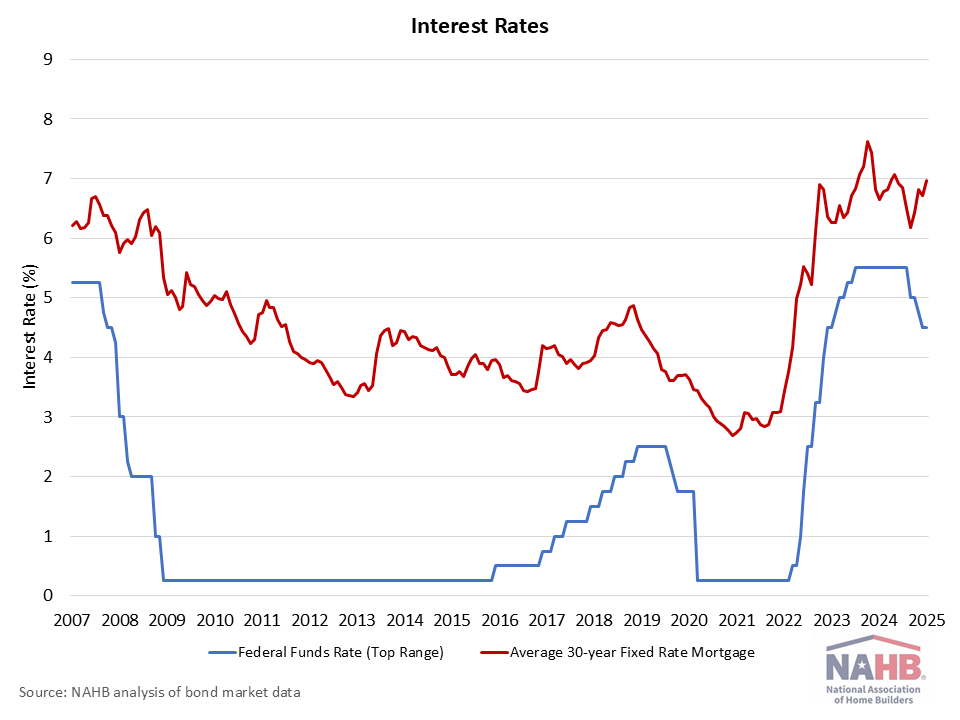

(January 30, 2025) -- In a widely anticipated announcement, the Federal Reserve paused on rate cuts at the conclusion of its January meeting, holding the federal funds rate in the 4.25% to 4.5% range. The Fed will continue to reduce its balance sheet, including holdings of mortgage-backed securities. The Fed noted the economy remains solid, while specifying a data dependent pause. Chair Powell did qualify current policy as “meaningfully restrictive,” but the central bank appears to be in no hurry to enact additional rate cuts.

While the Fed did not cite the election and accompanying policy changes today, the central bank did note that its future assessments of monetary policy “will take into account a wide range of information, including readings on labor market conditions, inflation pressures, and inflation expectations, and financial and international developments.” Given the ongoing, outsized impact that shelter inflation is having on consumers and inflation, an explicit mention to housing market conditions would have been useful in this otherwise exhaustive list.

Chair Powell did state in his press conference that housing market activity appears to have “stabilized.” A reasonable assumption is that this is a reference to an improving trend for rent growth (for renters and owners-equivalent rent), but the meaning of this statement is not entirely clear given recent housing market data and challenges. While improving, shelter inflation is running at an elevated 4.6% annual growth rate, well above the CPI. These housing costs are driven by continuing cost challenges for builders such as financing costs and regulatory burdens, and other factors on the demand-side of the market like rising insurance costs. And more fundamentally, the structural housing deficit persists.

From the big picture perspective, the Fed faces competing risks for future policy given changes in Washington, D.C. Tariffs and a tighter labor market from immigration issues represent upside inflation risks, but equity markets have cheered prospects for an improved regulatory policy environment, productivity gains and economic growth due to the November election. These crosswinds may signal a lengthy pause for monetary policy as the Fed continually seeks more short-term data.

While the Fed targets short-term interest rates, long-term interest rates have risen significantly since September, as a second Trump win came into focus. Fiscal policy and government debt levels will be a future risk for long-term interest rates and inflation expectations. Extension of the 2017 tax cuts will be good for the economy, but ideally, these tax reductions should be financed with government spending cuts. Otherwise, a larger federal government debt will place upward pressure on long-term interest rates, including those for mortgages.

The January Fed statement acknowledged the central bank’s dual mandate by noting that it would continue to assess the “balance of risks.” There was no language in today’s statement pointing to a future cut, although markets still expect one or two reductions in 2025 if inflation remains on a moderating trend.

Importantly, the Fed reemphasized that it is “strongly committed to support maximum employment and returning inflation to its 2 percent objective.” That seemed like a shot across the bow for those speculating that the Fed might be satisfied with achieving an inflation rate closer to but not quite 2%. While there is merit to debating the 2% policy, the emphasis today on the 2% target is a reminder of how important the housing market and housing affordability is for monetary policy and future macroeconomic trends.