(June 16, 2023) -- The newest study published by CommercialSearch ranks the country’s 20 best metros for the gig economy.

(June 16, 2023) -- The newest study published by CommercialSearch ranks the country’s 20 best metros for the gig economy.

Jobs data released by the Bureau of Labor Statistics at the start of May showed that, despite challenges across several sectors of the economy, the U.S. labor market continued to show resilience: 253,000 new jobs were added and the unemployment rate remained relatively stable below 3.5%. Plus, some economists noted that, even with such low unemployment numbers and a strong employment market, the gig workforce continued to grow.

Whether it’s freelance work in addition to a “day job,” full-time freelance for maximum flexibility, or temporary freelance work between traditional employment opportunities, people working as self-employed, independent contractors in a wide variety of occupations are estimated to represent as much as 15% of the workforce.

Of course, no matter the occupation, making the most out of the possibilities of gig work can depend greatly on location. As such, we set out to identify the U.S. metros with the best gig economy potential. To that end, we compared more than 70 of the most populous metropolitan areas in the U.S. and scored them across several indicators, which could add up to a maximum total score of 100 points (see the methodology section for details).

Read on for our findings on the top 20 U.S. metros for the gig economy, as well as highlights for each of the four major regions in the U.S. Additionally, following our metro area ranking highlights are insightful contributions from gig economy experts who share their takes on what drives success in the gig economy and what transformational potential it harbors.

Here are some of the key highlights:

- Phoenix ranked 13th among the best metros in the country but landed 3rd best within the Western U.S. region.

- With open coworking memberships estimated at a median price of $93 per person per month, coworking spaces in Phoenix stood out for offering some of the most affordable options among the metros we ranked.

- Among the top 10 Western U.S. metros, Phoenix was home to the 3rd-largest increase in the number of non-employer establishments — 19.5% in five years, behind Provo (23.6%) and Las Vegas (31.3%).

- Western U.S. metros represent the second-largest regional group in the mix, accounting for 18 of the 71 metros we compared for this ranking.

- Six of the top 10 metros in the Western U.S. also ranked among the best 20 metros for the gig economy nationwide: Denver, Las Vegas, Phoenix, Salt Lake City, Provo, and the San Jose MSA.

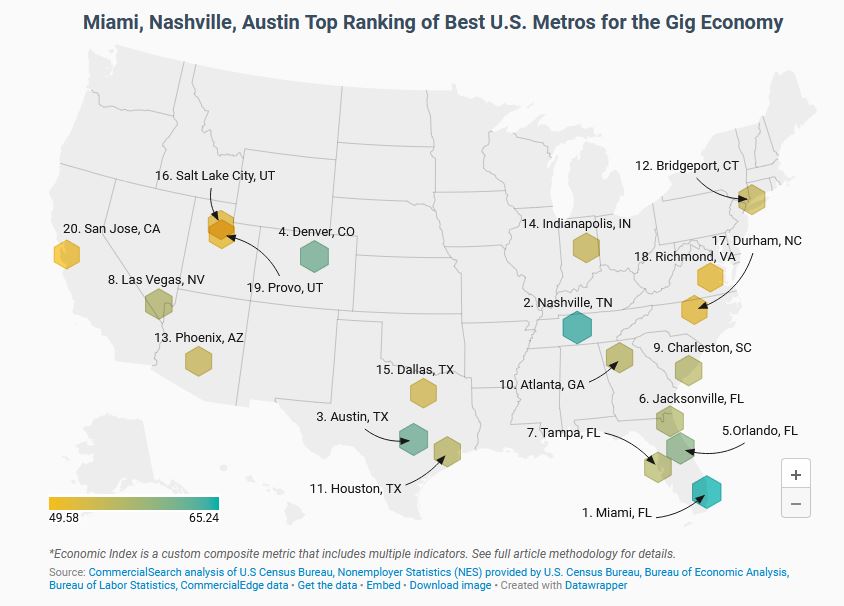

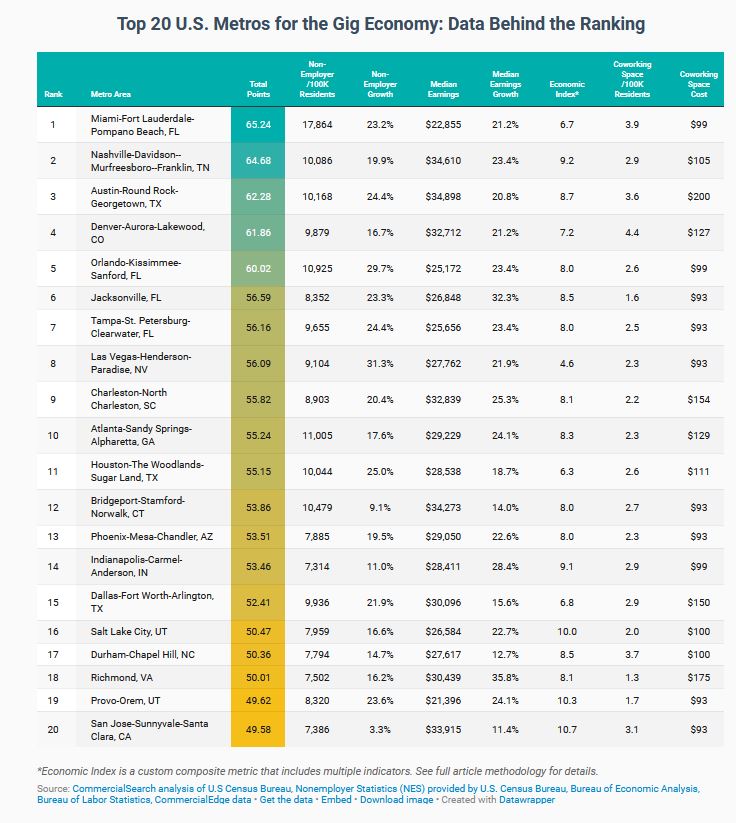

Top 20 U.S. Metros for the Gig Economy

The Miami metropolitan area earned the highest overall score (65 points) and took the #1 spot in our ranking. With a little more than 17,860 non-employer establishments per 100,000 residents, Miami stood out for the highest ratio of self-employed residents out of all of the metros we compared for this ranking. Notably, the metro also boasted one of the 10 highest rates of growth for non-employer establishments: With an increase of 23.2% throughout five years, Miami was roughly on par with San Antonio, Texas, as well as very close behind Jacksonville, Fla. (23.3%).

Freelancers in need of flexible workspace here will find that the south Florida metro boasts the third-highest coworking space density — an estimated 3.9 coworking spaces per 100,000 residents. What’s more, Miami coworking space also ranked among the top 10 most affordable on our list with a median price of $99 per person per month.

The second-best U.S. metro for gig work was Nashville, Tenn., which earned a total score of nearly 65 points. The annual median earnings for self-employed residents operating unincorporated businesses here was roughly $34,600 — fifth-highest among the metros we compared and not far behind Boston; Austin, Texas; New Haven, Conn.; and San Francisco. Nashville also scored among the top 10 for density of non-employer establishments: Its ratio of 10,086 businesses per 100,000 residents scored ninth-best, ahead of Houston and behind the New York metro area. Meanwhile, the density of coworking spaces in Nashville (2.9 per 100,000 residents) scored roughly on par with Dallas and Indianapolis, as well as closely behind San Jose, Calif. (3.1/100,000).

At the same time, Austin, Texas, was the third-best metro for the gig economy, with a little more than 62 points out of 100. Specifically, the hip Texas metro was home to the seventh-highest density of non-employer establishments (10,168 per 100,000 residents), scoring closely behind New Orleans. Moreover, non-employer numbers here increased 24.4% throughout five years, which represented the fourth-largest such growth among the metros we compared. However, Austin ranked even better in terms of earnings: Self-employed residents operating unincorporated businesses in the Austin-Round Rock metropolitan statistical area (MSA) had annual median earnings of $34,898. Notably, that was the third-largest in our ranking, behind only New Haven, Conn., and San Francisco. Accordingly, freelance professionals here also have a relatively abundant choice of flexible workspace: Austin coworking space had the fifth-highest density in our ranking (3.6 coworking spaces per 100,000 residents).

Next, the Denver metropolitan area continued to rank among the best places for entrepreneurial professionals. With a total score of almost 62 points, Denver ranked as the fourth-best U.S. metro for the gig economy. In particular, its strongest-performing indicator was flexible workspace density. In fact, Denver’s coworking space ratio of 4.4 spaces per 100,000 residents was the highest among the 71 metros we compared, followed by Washington, D.C. and Miami. Here, the number of non-employer establishments increased by nearly 17% in five years. And, according to the most recent Census Nonemployer Statistics (NES) data, the Mile High City also reached a density of roughly 9,880 per 100,000 residents (12th-largest in our ranking). Furthermore, the annual median earnings of self-employed Denver metro residents operating unincorporated businesses ranked 11th-highest, which placed Denver ahead of both Baltimore and Washington, D.C.

The fifth-best score went to the Orlando, Fla., metropolitan area. The MSA rounded out the top five with a little more than 60 points in total, ahead of in-state neighbors Jacksonville and Tampa. Namely, the central Florida MSA showed the second-largest increase in number of non-employer establishments — 29.7% in five years — ahead of Houston and second only to the Las Vegas MSA. On the heels of that growth, Orlando was also home to the third-highest non-employer establishment density (10,925 per 100,000 residents) among the metros in our ranking, ahead of Los Angeles and behind only Atlanta and Miami.

Next, the Denver metropolitan area continued to rank among the best places for entrepreneurial professionals. With a total score of almost 62 points, Denver ranked as the fourth-best U.S. metro for the gig economy. In particular, its strongest-performing indicator was flexible workspace density. In fact, Denver’s coworking space ratio of 4.4 spaces per 100,000 residents was the highest among the 71 metros we compared, followed by Washington, D.C. and Miami. Here, the number of non-employer establishments increased by nearly 17% in five years. And, according to the most recent Census Nonemployer Statistics (NES) data, the Mile High City also reached a density of roughly 9,880 per 100,000 residents (12th-largest in our ranking). Furthermore, the annual median earnings of self-employed Denver metro residents operating unincorporated businesses ranked 11th-highest, which placed Denver ahead of both Baltimore and Washington, D.C.

The fifth-best score went to the Orlando, Fla., metropolitan area. The MSA rounded out the top five with a little more than 60 points in total, ahead of in-state neighbors Jacksonville and Tampa. Namely, the central Florida MSA showed the second-largest increase in number of non-employer establishments — 29.7% in five years — ahead of Houston and second only to the Las Vegas MSA. On the heels of that growth, Orlando was also home to the third-highest non-employer establishment density (10,925 per 100,000 residents) among the metros in our ranking, ahead of Los Angeles and behind only Atlanta and Miami.

In the West, Las Vegas & Los Angeles Earn Top Scores for Non-Employer Business Numbers

The second-largest regional group in the mix was represented by Western U.S. metros, which accounted for 18 of the 71 metros we compared for this ranking. It’s worth noting that six of the regional selections included here also ranked among the top 20 U.S. metros for the gig economy — Denver; Las Vegas; Phoenix; Salt Lake City; Provo, Utah; and San Jose, Calif.

First, Las Vegas boasted the highest rate of growth for non-employer establishments in the region with an increase of 31.3% throughout five years. This marked a larger rate of growth than was recorded in similarly sized metro areas, such as Denver.

Even so, the largest non-employer business sector in the Western U.S. region was in Los Angeles, which was home to 10,888 non-employer establishments — ahead of Denver and San Francisco. Moreover, Los Angeles was also home to one of the most abundant coworking space scenes in the Western U.S.: There were 3.4 coworking spaces per 100,000 metro residents here, behind only San Diego and Denver.

In terms of coworking space cost, the metros offering the most affordable options in the region were San Jose, Calif.; Phoenix; Las Vegas; and Provo, Utah, where the median price for open coworking space was $93 per person per month.