REO Inventory Rising Once Again

REO Inventory Rising Once Again

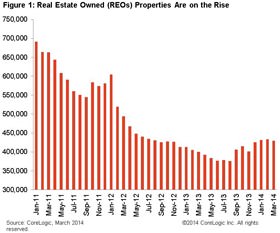

CoreLogic reports that after reaching a trough in August of 2013 of 375,000 properties, the number of real estate owned (REO) properties increased 15 percent to 430,000 as of March 2014 (Figure 1). The increase in REO properties was broad based, rising in 46 states. While the increase was moderate nationally, some states had large increases. Idaho led the way with the stock of REO properties nearly doubling between August 2013 and March 2014. Maryland had the 2nd largest increase in the number of REO properties, which increased 78 percent, followed by Nevada (up 70 percent), Oregon (up 47 percent) and North Dakota (up 42 percent).

The rise in REOs across most states reflects several inter-related factors. The “robo-signing” scandal in the fall of 2010 caused servicers to delay the foreclosure process, increasing foreclosure timelines. The number of REO properties had been increasing until September 2010 when the issue became public and after September the flow of completed foreclosure immediately fell by one-third in October 2010 and remained lower. That caused a rapid fall off in the number of REO properties until very late 2011 and early 2012 when the number REO properties began to rise again. Not surprisingly, the rise in the number of REO properties coincided with the National Mortgage Settlement, which was signed in February 2012 and provided more clarity and standards on foreclosure resolutions which led to the rise in REO properties.

As lenders began to accelerate the foreclosure process in early 2012, investor demand for REO properties began to rapidly increase. Investor demand more than offset the acceleration of foreclosure resolutions and led to a rapid decline in the number of REO properties. However, investor demand began to drop off last September partly in response the twin impact of rapid price increases and the rise in mortgage rates. In addition, short sale activity reached its peak in late 2012 and early 2013 and began to decline in subsequent months due to the Mortgage Forgiveness Debt Relief Act of 2007. Some properties that may have avoided foreclosure as short sales are instead being foreclosed upon and contributing to the rise in the REO stock.

The combination of all these major factors began to coalesce during the fall of 2013 and led to a rise in the inventory of REO properties. While the level is lower than the peak in the crisis, it signals that the rapid improvement in the REO stock during the last two years is over and the market has entered a new phase as it continues to process the legacy of the foreclosure crisis.