By George W. Hammond, Ph.D.

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

The University of Arizona’s Economic & Business Research Center (EBRC) is reporting in its economic scorecard for 2015 shows the state of the economy added jobs, residents, and income. Labor market performance improved, with 61,600 net new jobs and an unemployment rate of 6.1% according to the preliminary data. Arizona also added just over 91,000 new residents last year, with positive net migration. Personal income is expected to rise by 4.9%, slightly faster than in 2014. The Phoenix metropolitan statistical area (MSA) continued to drive state growth, but the Tucson MSA managed to grind out slow gains. Overall, 2015 was a solid but not great year.

Look for modest improvements in job, population, and income growth in 2016, but keep an eye on national/global growth risks as well. Recent stock market declines, if sustained, may weigh a bit on consumer spending, particularly for luxury goods. Low oil and gasoline prices are a net positive for Arizona, but they are having an adverse impact on oil producing states, for instance Texas and Mexico. The major increases in the value of the U.S. dollar during the past year and a half will impact U.S. exporters of goods and services, including exporters in Arizona. Further, possible monetary policy mistakes remain a concern as we look to the future, as does growth of our major trading partners.

Arizona also faces risks related to U.S. residential mobility, which has been slow to recover from the Great Recession. If mobility does not increase as expected, it will dampen state population gains and the housing recovery.

Arizona Recent Developments

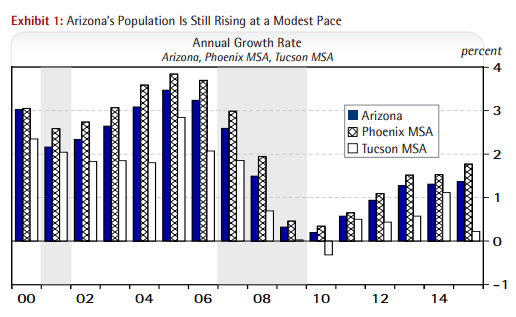

In December, the Arizona Department of Administration released population estimates for the state, counties, and cities for 2015. The data put the state’s population at 6,758,251 on July 1, which was up by 91,010, or 1.4%, from 2014. That was a slight improvement over growth in 2014 (at 1.3%) but it was also less than one half of our average growth rate during the 30 years before the Great Recession (3.2% per year)

As Exhibit 1 shows, both the Phoenix and Tucson metropolitan statistical areas (MSAs) added residents last year. The Phoenix MSA (Maricopa and Pinal counties) added 78,018 residents last year, which translated into a rate of 1.8% and accounted for 85.7% of statewide population gains. The data put population in Phoenix at 4,482,906. The Tucson MSA (Pima County) also added residents last year, but at a far slower pace than the state or Phoenix. The latest estimates put Tucson’s population at 1,009,371 in 2015, up 2,209 or 0.2%.

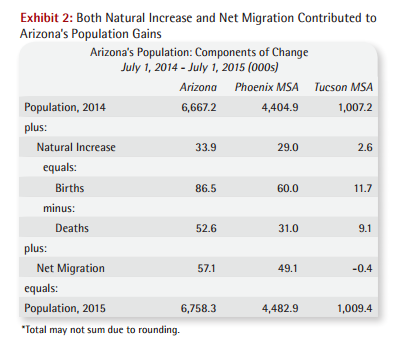

Arizona’s population gains last year were driven both by natural increase and net migration. Natural increase is the difference between births and deaths. Net migration is the difference between in-migration and out-migration during the year. As Exhibit 2 shows, positive net migration contributed more to Arizona’s population increase than did natural increase. Of the roughly 91,000 increase during the year, 33,900 were due to the difference between births and deaths. Net migration contributed more, with an estimated 57,100 more people moving in than moving out.

Arizona continues to generate solid job gains. In 2015, the state added 61,600 jobs, up from 49,100 in 2014. Job gains in 2015 translated into a growth rate of 2.4%, up from 1.9% in 2014. While job growth in the state beat the national average last year (of 2.1%) our pace fell below the average established during the 1977-2007 period, which was 4.1% per year. The Phoenix MSA added 54,500 jobs last year, which translated into a rate of 2.9%. That was faster than the pace set in 2014, of 2.4%. Job gains in Tucson continued at a slow pace last year, with an increase of 1,500 (0.4%). Keep in mind that all of the employment data referenced here is based on EBRC’s internal benchmark of the raw data from the U.S. Bureau of Labor Statistics.

Arizona continues to generate solid job gains. In 2015, the state added 61,600 jobs, up from 49,100 in 2014. Job gains in 2015 translated into a growth rate of 2.4%, up from 1.9% in 2014. While job growth in the state beat the national average last year (of 2.1%) our pace fell below the average established during the 1977-2007 period, which was 4.1% per year. The Phoenix MSA added 54,500 jobs last year, which translated into a rate of 2.9%. That was faster than the pace set in 2014, of 2.4%. Job gains in Tucson continued at a slow pace last year, with an increase of 1,500 (0.4%). Keep in mind that all of the employment data referenced here is based on EBRC’s internal benchmark of the raw data from the U.S. Bureau of Labor Statistics.

Arizona Outlook

The U.S. economy continues to grow at a modest pace, with real GDP rising by 2.4% in 2015. That was the same pace posted in 2014. The IHS Economics’ forecast calls for gains to accelerate modestly during the next two years, with real GDP growth rising to 2.7% next year and 2.9% in 2017. This is driven by less drag from the inventory cycle, federal spending, and energy-sector capital spending. In addition, the housing sector is expected to continue to gain momentum.

Consumer spending is expected to remain a solid contributor to growth during the forecast, supported by income and job gains. Auto and light truck sales remain a bright spot.

Net exports are expected to be a small drag on the U.S. economy during the next three years, as a stronger dollar reduces export competitiveness and increases imports. With world interest rates and growth becoming more synchronized during the next three years, the dollar is forecast to gradually retreat.

The outlook for interest rates calls for the Federal Reserve to gradually push rates up during the next four years. Overall, the interest rate outlook calls for the 10-year Treasury note yield to rise from 2.14% on average in 2015 to 3.82% by 2019.

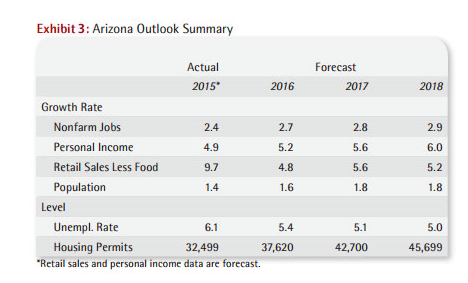

Exhibit 3 summarizes the outlook for Arizona in the near term. Overall, the forecast calls for the state gain momentum during the next three years. Job growth is forecast to accelerate from 2.4% in 2015 to 2.9% by 2018. Population and income gains show a similar pattern. Overall, if the national economy continues to expand, the state is well positioned for stronger growth. However, that growth is expected to remain well below long-run historical averages.

The Phoenix MSA is forecast to continue to drive state gains, with job growth rising from 2.9% in 2015 to 3.2% by 2018. That far outpaces growth in the Tucson MSA, where job gains accelerate from 0.4% in 2015 to 1.5% by 2018.

The Phoenix MSA is forecast to continue to drive state gains, with job growth rising from 2.9% in 2015 to 3.2% by 2018. That far outpaces growth in the Tucson MSA, where job gains accelerate from 0.4% in 2015 to 1.5% by 2018.

For full article click here.

Breakfast with the Economists will be held June 1, 2016 with EBRC Director and Research Professor George W. Hammond, Ph.D., will be joined by Ross DeVol, Chief Research Officer at the Milken Institute. Details and registration coming soon.