Sossaman Business Campus. 3327 South Sossaman Road, Mesa, Arizona (December 2024)

PHOENIX, AZ (April 22, 2025) -- Over the last two years, the Phoenix industrial market has experienced notable shifts, defined by a steady decline in construction activity, rising vacancy rates, and consistent yet insufficient absorption to offset new supply. These trends suggest an impending rebalancing of the market. As construction slows and absorption remains steady, a predictable shift is approaching, with vacancies likely to peak and then begin their decline. For developers, preparing to act ahead of this curve will be critical to success in 2025 and beyond.

The following information highlights key market trends, data insights and the implications for developers in the Phoenix industrial market. By examining construction activity, vacancy rates and absorption patterns, this report provides a clear understanding of the challenges and opportunities ahead. Equipped with these insights and the support of a trusted partner, developers can make informed decisions and strategically position themselves to act.

Key Report Takeaways

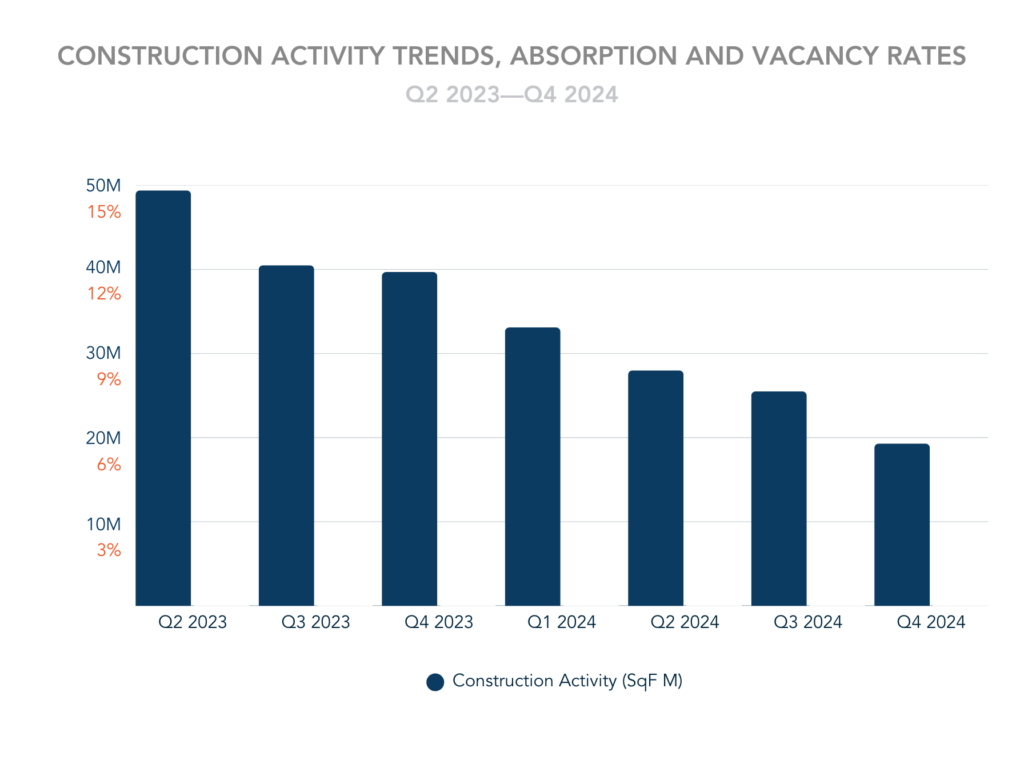

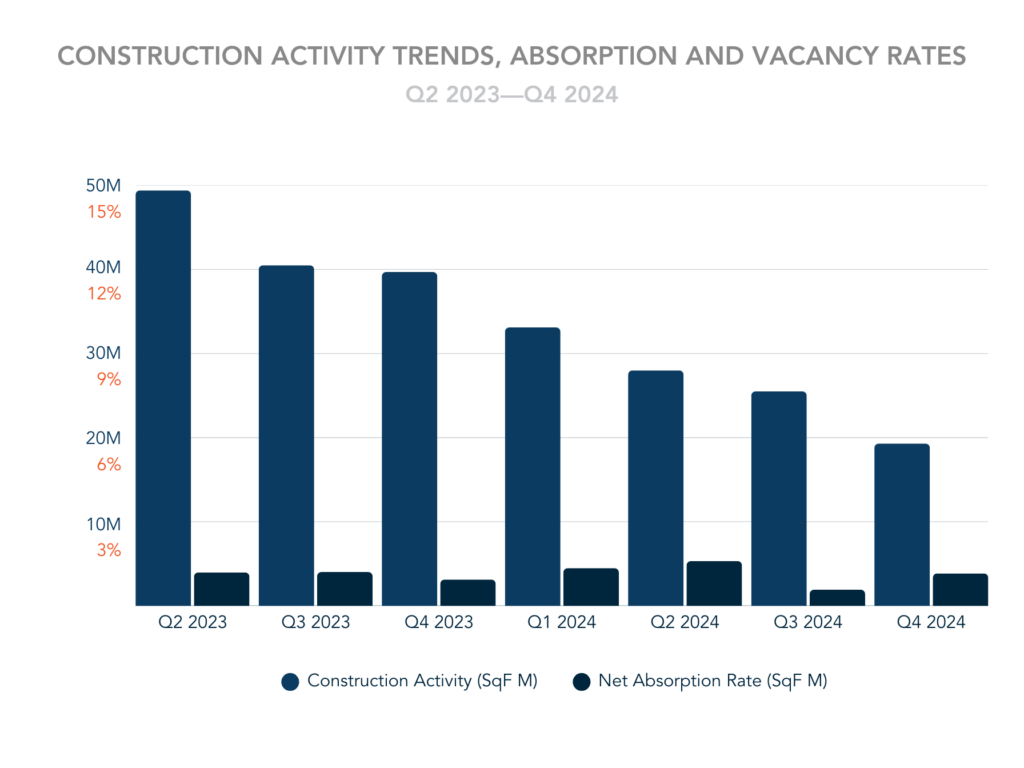

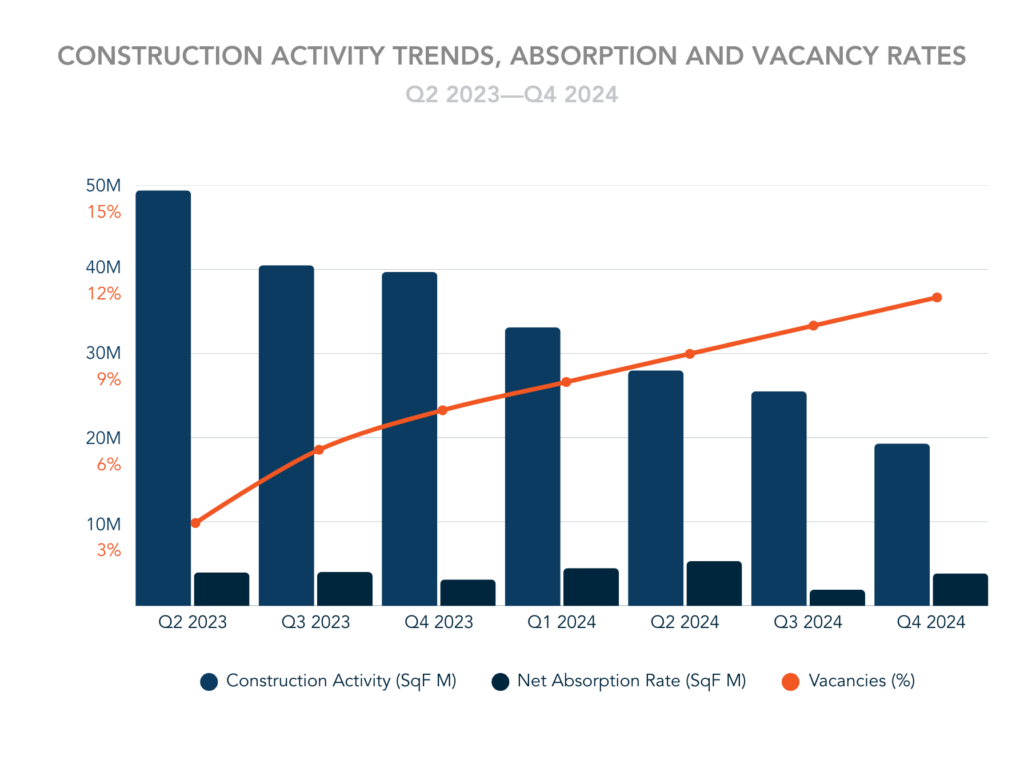

- Construction activity reduced significantly from 49.3M SF in Q2 2023 to 19.3M SF in Q4 2024, indicating a cautious approach by developers amid rising vacancies.

- Vacancy rates increased from 6.7% in Q4 2023 to 10.6% in Q4 2024, with new supply consistently outpacing absorption. Certain submarkets are especially oversaturated and have vacancy rates in excess of 20%.

- Net absorption remained positive but modest, highlighting demand for high-quality, move-in-ready spaces.

- Linear decline in construction activity quarter-over-quarter, coupled with consistency in absorption quarter-over-quarter suggests a relatively predictable inflection point in the near future, where vacancy rates are likely to peak before beginning to decline.

- In 2025, developers are uniquely positioned to plan strategically alongside a trusted partner.

2024 Market Performance Overview

Construction Activity Trends

Construction activity in Phoenix displayed a steady, linear decline. This suggests a strategic response by developers to rising vacancies (as noted below) and the broader economic landscape. This trend, coupled with data on new construction starts, highlights a level of market predictability, indicating that construction activity will continue to slow until vacancy rates start to stabilize.

Vacancy & Absorption Rate Trends

Vacancy rates in Phoenix climbed significantly in 2024, yet net absorption remained stable quarter-over-quarter. This stability indicates that despite elevated vacancies, the demand for high-quality, move-in-ready spaces remains, particularly in submarkets less impacted by oversupply.

New Supply & Leasing Trends

- Q1: 9.7M SF delivered

- Q2: 10.0M SF delivered

- Q3: 6.7M SF delivered

- Q4: 7.87M SF delivered

New supply trends, which typically lag behind construction activity, also reflected a decline in 2024. Notably, nearly 33% of Q4 deliveries were pre-leased, highlighting the continued demand for tenant-improved spaces. For developers, focusing on ready-to-occupy properties with high-quality finishes will be critical in attracting leases quickly.

2025 Implications for Developers to Consider

Market Predictability & Strategic Development Planning

The predictable trends defined above provide developers with a unique opportunity to plan strategically. Developers who prepare now by focusing on tenant-improved, move-in-ready spaces will gain a competitive advantage as the market rebalances.

What Developers Can Expect

As market preferences evolve, the focus is expected to shift away from large-scale projects and toward smaller, demisable spaces that offer greater flexibility for tenants. This trend reflects the growing demand for adaptable spaces that can accommodate a variety of uses, from last-mile distribution to light manufacturing.

Developers who incorporate these elements will not only appeal to a broader range of tenants but also position themselves to respond quickly to changing market needs if necessary. Emphasizing customizable layouts built on strategically located sites can further enhance the appeal of these smaller, versatile spaces, making them an attractive option for both regional and national tenants looking for efficiency and scalability.

Taking Action: Strategic Next Steps

Although elevated vacancies present challenges, the predictability of market trends points to a cautiously optimistic outlook for 2025. Developers who act now, prioritizing tenant-ready spaces, will be better positioned to capitalize on the approaching inflection point in vacancy rates.

Starting the planning process now allows developers to get ahead of the competition and take advantage of competitive subcontractor pricing. By driving preliminary design and pre-construction services during the due diligence period at no cost, ARCO minimizes developers’ risk without the financial burden of traditional contractors. This service provides developers with valuable insights and planning support early in the process, helping them make informed decisions without financial commitments.

Engaging with a trusted partner like ARCO early helps developers navigate the shifting market, align developments with tenant demands and streamline project timelines. Scheduling a consultation with our team is the first step toward optimizing your next industrial project. If you’re a developer looking to set yourself up for success in 2025, partnering with ARCO Phoenix can help you minimize risks and position your developments strategically for the future.

To start the conversation, please email Vice President of Phoenix Operations, BJ Keane, at bjkeane@arco1.com, or call 602.805.9082.