By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

The Winter 2016 Issue of Ariona’s Economy is now available for browsing online and for download in PDF

UA Economic and Business Research Center (EBRC) Director George W. Hammond’s fourth quarter 2015 forecast update "Tales of Two Cities: Arizona's Two Largest Metro Areas Diverge," gives you the lowdown on our end-of-year forecast for Arizona and the nation. Dr. Hammond goes on to analyze factors driving the widely differing economic performance and recovery in the Phoenix and Tucson metros. You'll also find EBRC’s latest forecast data for important economic measures for the Arizona, Phoenix and Tucson metros.

The Arizona economy is expanding at a solid, but unspectacular, pace. However, those gains are very unevenly distributed across the state. The Phoenix metropolitan statistical area (MSA), composed of Maricopa and Pinal counties, accounted for most of the state’s job growth during the past year. In contrast, the Tucson MSA (Pima County) generated no net job gains. The rest of the state posted slow job growth. Overall, Arizona remains stuck in low gear, in large part because fiscal drag and low U.S. residential mobility continue to hinder key sectors. The forecast calls for growth to accelerate as these factors gradually loosen their grip.

Phoenix MSA Outlook: Sustained Rapid Growth

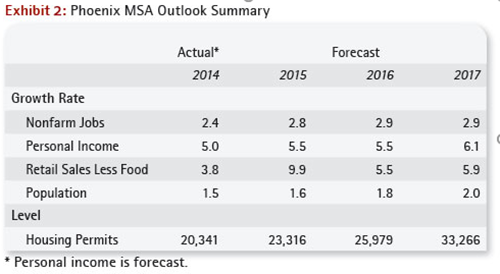

The Phoenix metropolitan statistical area (MSA) economy is expanding at a faster rate than the nation. As Exhibit 1 shows, job growth in the metropolitan area, which includes Maricopa and Pinal counties, has been above the national average since mid-2011. From the third quarter of 2014 to the same quarter of this year, the Phoenix MSA added 48,800 jobs. That translated into a growth rate of 2.7%, which was well above the national rate of 2.0%. It also accounted for 88.1% of net job growth statewide. Keep in mind that the employment data seen here is based on EBRC’s benchmark of the raw BLS data.

Through September 2015, housing permit activity in the Phoenix MSA has increased strongly, with permits up 17.8% compared to the same period last year. Most of that strength was concentrated in single family permits, which were up 38.9% over 2014. Multi-family permits were running 8.8% below their 2014 rate. Overall, housing permits are showing signs of strength so far this year, which suggests stronger gains in construction employment in 2016, assuming that builders can overcome a tight construction labor market.

Through September 2015, housing permit activity in the Phoenix MSA has increased strongly, with permits up 17.8% compared to the same period last year. Most of that strength was concentrated in single family permits, which were up 38.9% over 2014. Multi-family permits were running 8.8% below their 2014 rate. Overall, housing permits are showing signs of strength so far this year, which suggests stronger gains in construction employment in 2016, assuming that builders can overcome a tight construction labor market.

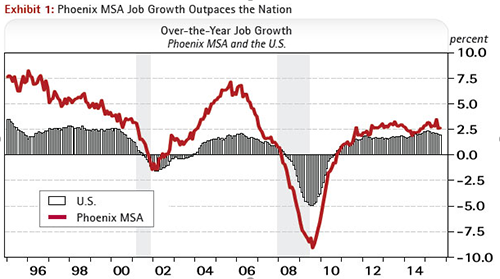

The outlook for the Phoenix MSA is summarized in Exhibit 2. The forecast calls for economic growth to strengthen during the next three years, with job growth reaching 2.9% by 2017. Stronger job gains translate into faster growth in personal income and retail sales. Keep in mind that the strong growth in retail sales in 2015 is likely related to a change in tax law that is reallocated sales from contracting to the retail category.

Tucson MSA Outlook: Growing, but Still Slow

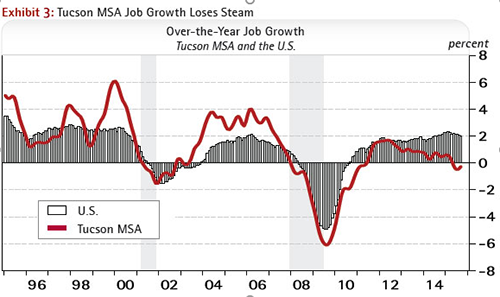

The Tucson MSA (Pima County) has been losing steam during the past three years, with gradually decelerating job gains (Exhibit 3). As the graph suggests, monthly data for Tucson tends to be volatile, so it is wise to focus on more on quarterly/annual data. In the third quarter of 2015, Tucson’s employment was virtually unchanged from a year ago. That’s a big contrast with the nation, state, and Phoenix MSA, each of which added jobs at a rate of 2.0% or greater. Keep in mind that the employment data seen here is based on EBRC’s benchmark of the raw BLS data.

Performance has been quite different across industries during the past four quarters. Professional and business services; leisure and hospitality; education and health care; financial activities; and information all added jobs. However, those gains were roughly offset by losses in natural resources and mining; other services; manufacturing; construction; trade, transportation, and utilities; and government.

Performance has been quite different across industries during the past four quarters. Professional and business services; leisure and hospitality; education and health care; financial activities; and information all added jobs. However, those gains were roughly offset by losses in natural resources and mining; other services; manufacturing; construction; trade, transportation, and utilities; and government.

The government sector generated the largest job losses over the year, with the big decline coming in state and local government. These losses reflect employment reductions at the University of Arizona, as well quirks in the counting of teachers returning to work.

Overall, Tucson’s slow growth since 2012 has reflected the impact of fiscal drag. During 2013-2014, this was primarily driven by federal fiscal drag, with the imposition of the sequester and other federal budget cuts. Lately, state and local fiscal drag has become more of an issue, with state budget cuts affecting the local economy.

Fiscal drag tends to impact Tucson more than Phoenix or the state as a whole. This happens simply because federal and state/local activity is a larger share of the local economy. Government (federal civilian and military, as well as state and local) accounted for 21.9% of Tucson’s GDP in 2014, compared to 12.4% for the U.S., 13.8% for the state, and 10.1% for Phoenix.

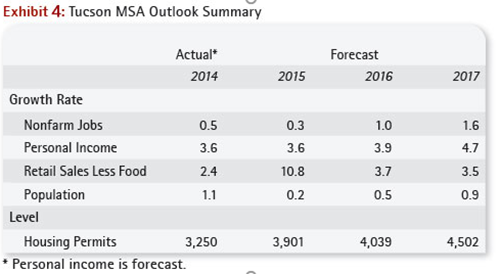

The forecast calls for Tucson to grow during the next three years, but at a modest pace (Exhibit 4). Job growth accelerates from 0.3% in 2015 to 1.6% by 2017. The acceleration reflects less federal (and state and local) fiscal drag, as well as increased U.S. residential mobility which boosts population gains.

Risks to the Forecast

Risks to the Forecast

One major risk to the baseline forecasts for Phoenix and Tucson is the possibility of a downturn in the U.S. economy. A U.S. recession would take the wind out of Arizona’s sails, and push growth down or even generate a recession for Phoenix and Tucson.

In addition, there are state-specific risks to the outlook, particularly the risk that U.S. residential mobility never increases substantially above current levels. This would generate much slower-than-expected state population gains and the housing sector would not recover to the degree expected in the baseline forecast.

In addition, a continued appreciation in the value of the U.S. dollar carries risks for the state. Exports, particularly to Mexico, have been a bright spot for the state economy during the past year. A much stronger dollar would weigh on exports during the next couple of years, adversely affecting both merchandise exports and international tourist expenditures.

Click here for the Full 2016 Forecast 2016